Introduction

As we step into 2024, many investors are contemplated the viability of rental properties as a potential investment avenue. With fluctuate market conditions and evolve economic landscapes, it’s crucial to assess whether invest in rental properties is a sound financial decision this year. This article will provide a comprehensive overview of the factors will influence rental property investments in 2024, will offer insights, tips, and guidance for prospective investors.

Source: happymaggie.pages.dev

Source: happymaggie.pages.dev Understand the current market

To determine if rental properties are a good investment in 2024, it’s essential to begin understand the current real estate market trends:

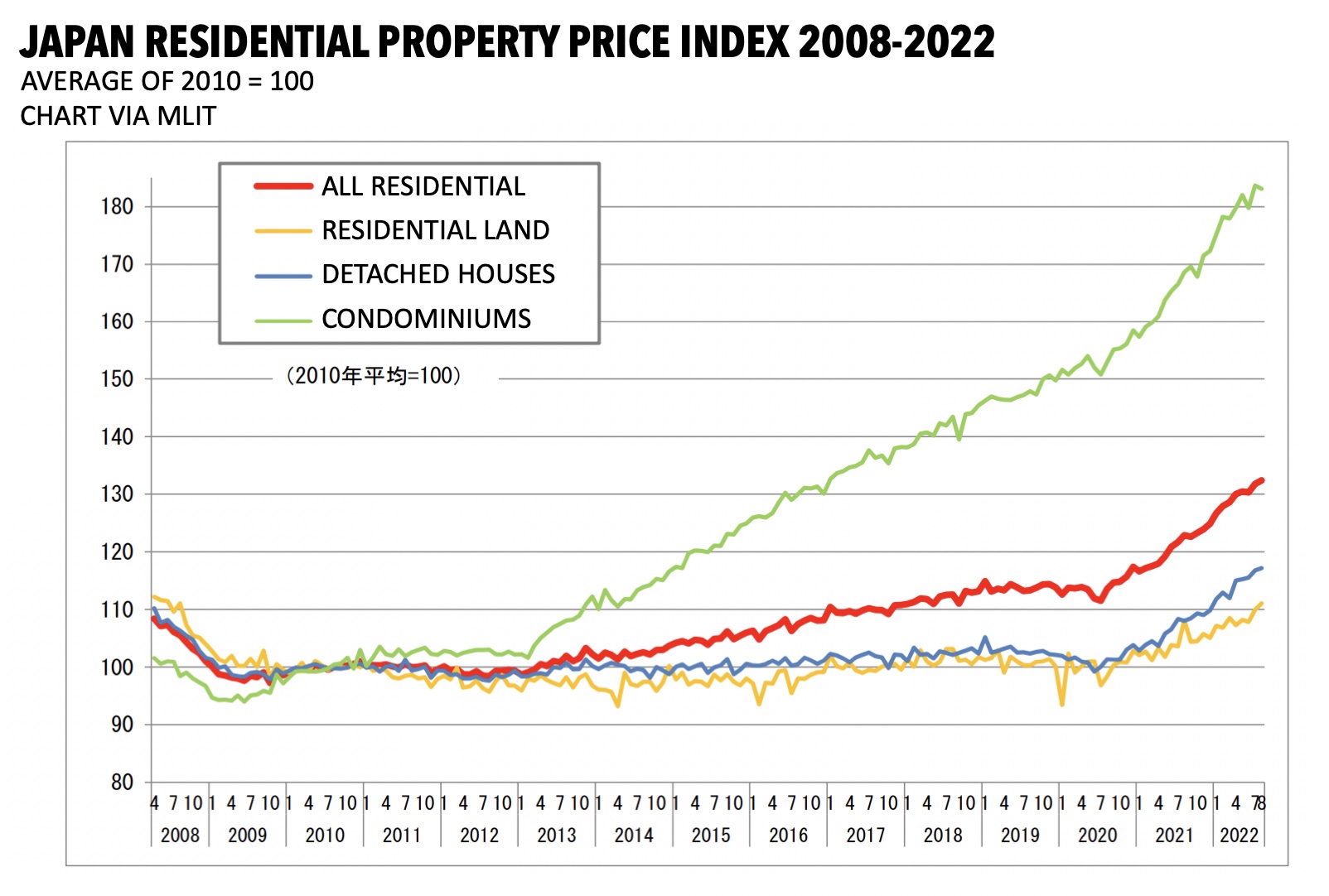

- Economic conditions: The global economy has experience significant shifts over the past few years, impact property values and rental yields. Will monitor interest rates, inflation, and employment rates will offer a clearer picture of market stability.

- Demand and supply: Urban areas continue to see high demand for rental properties, drive by population growth and the increase preference for rent over buying among younger generations.

- Technological advancements: Platforms like Airbnb and VRB have ttransformedthe rental property landscape, offer additional revenue streams through short term rentals.

Advantages of investing in rental properties

Rental properties can offer several benefits for investors, include:

- Steady income stream: Rental properties can provide a consistent monthly income, which can be particularly appeal in times of economic uncertainty.

- Appreciation: Over time, real estate properties tend to appreciate in value, contribute to long term wealth accumulation.

- Tax benefits: Investors can benefit from various tax deductions, include mortgage interest, property taxes, and depreciation.

- Diversification: Real estate can diversify an investment portfolio, reduce overall risk.

Challenges and risks

Despite the benefits, there be challenges and risks associate with rental property investments:

- Market volatility: Property values can fluctuate, and economic downturns may impact rental demand and income.

- Maintenance and management: Rental properties require ongoing maintenance and management, which can be time consume and costly.

- Regulatory changes: Changes in local property laws or regulations can affect rental income and property values.

Real life example

Consider the case of Sarah, an investor who purchase a rental property in a bustling urban area in late 2023. By leverage a low interest mortgage rate and capitalize on the demand for rental spaces in her city, Sarah was able to secure long term tenants rapidly. Notwithstanding, she to face challenges with unexpected maintenance costs and regulatory changes that require adjustments to her rental agreements. Sarah’s experience underscore the importance of thorough market research and financial planning when invest in rental properties.

Source: dolcubb2lessonlearning.z13.web.core.windows.net

Source: dolcubb2lessonlearning.z13.web.core.windows.net Tips for successful rental property investment in 2024

Here are some practical tips for those consider rental property investments in 2024:

- Conduct market research: Analyze local market conditions, include demand trends, rental prices, and potential growth areas.

- Evaluate financials: Calculate potential returns, account for expenses like property management, maintenance, and insurance.

- Diversify locations: Consider invest in multiple locations to spread risk and increase income opportunities.

- Stay informed: Keep abreast of economic indicators and regulatory changes that could impact your investment.

Conclusion

Invest in rental properties in 2024 present both opportunities and challenges. By conduct thorough research, evaluate financial prospects, and stay inform about market trends, investors can make informed decisions that align with their financial goals. As you consider diving into the rental property market, remember that knowledge and preparation are key to successful investment outcomes. For further exploration, consult real estate professionals and continue to educate yourself on emerge market dynamics.