Introduction

Decide whether to lease or buy a vehicle is a significant financial decision that can impact your budget, lifestyle, and future plans. Each option carry its own set of advantages and potential drawbacks, make it crucial to understand both before make a commitment. This article will guide you through the critical aspects of will lease and buy a vehicle, will offer insights and real world examples to will help you make an informed choice.

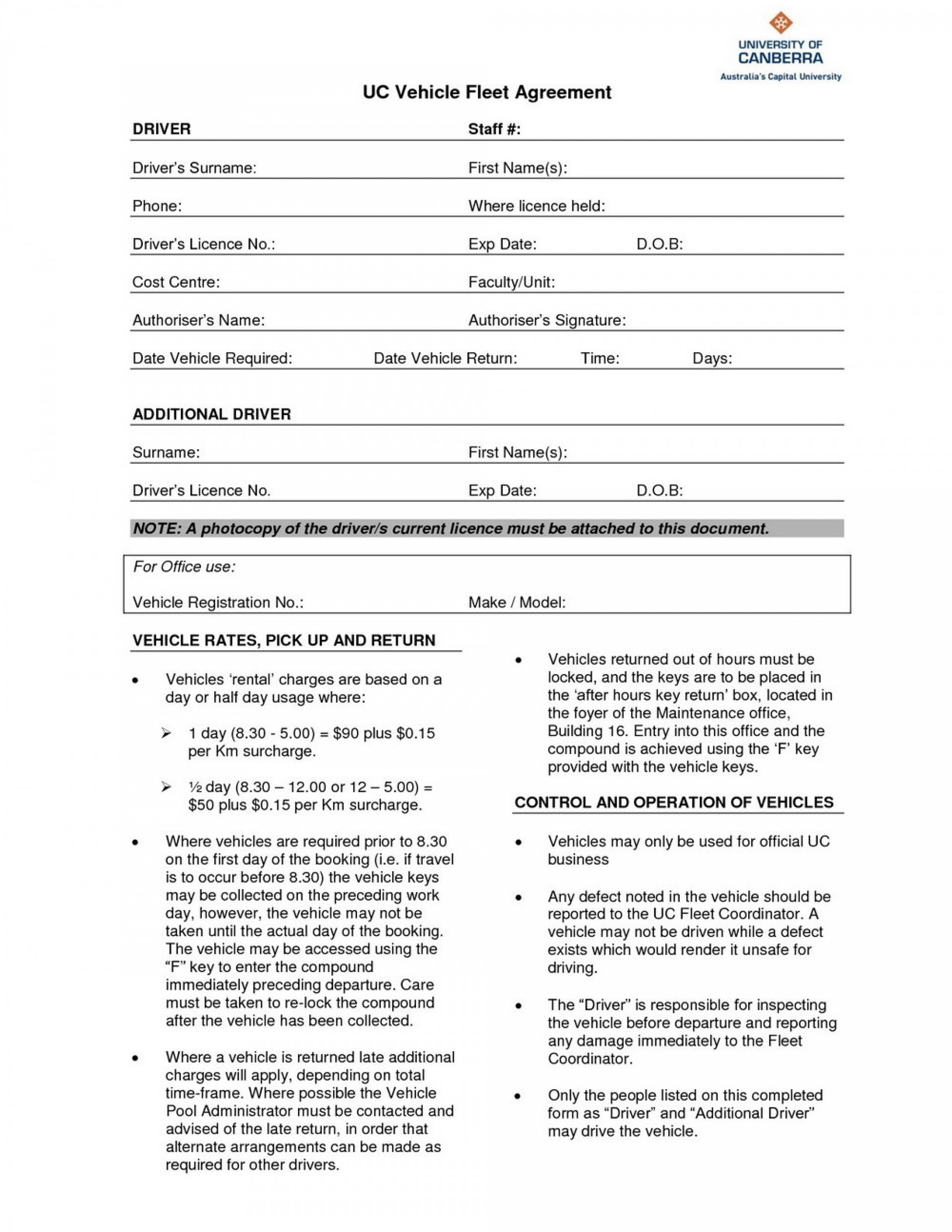

Source: homologacao.agroline.com.br

Source: homologacao.agroline.com.br Understand leasing vs. Buy

Before dive into the benefits and drawbacks, it’ important to understand what leasing and buying mean:

- Leasing: When you lease a vehicle, you’re basically rent it for a specify period, typically two to four years. At the end of the lease term, you can return the car, purchase it, or lease another vehicle.

- Buy: Buying involve pay for the vehicle unlimited or through financing, make you the owner. This can be done through cash purchase or a loan.

Pros and cons of leasing

Pros:

- Lower monthly payments: Lease payments are mostly lower than loan payments since you’re solely pay for the vehicle’s depreciation during the lease term.

- Access to newer models: Leasing allow you to drive a new car every few years with the latest technology and features.

- Less maintenance hassle: Most lease terms coincide with the vehicle’s warranty period, reduce repair costs.

Cons:

- Limited mileage: Leases frequently come with mileage caps, and exceed them can result in expensive penalties.

- No ownership: At the end of the lease, you don’t own the vehicle and must return it unless you choose to buy it.

- Potential fees: You could face additional fees for excessive wear and tear.

Pros and cons of buying

Pros:

- Ownership: When you buy a vehicle, it’s yours to keep, modify, and sell at any time.

- No mileage limits: You can drive equally lots as you want without worry about penalties.

- Long term cost: Although upfront costs are higher, buy can be more economical over time if you keep the car for several years.

Cons:

- Higher monthly payments: Purchasing mostly involve higher monthly payments compare to leasing.

- Depreciation: Vehicles depreciate rapidly, which can affect resale value.

- Maintenance costs: After the warranty expire, you’re responsible for all repair costs.

Real life example

Consider the case of Alex, a young professional who latterly face the dilemma of leasing or buying. Initially attract by the lower monthly lease payments, Alex opt for a lease on a luxury sedan. Notwithstanding, after often exceed the mileage cap due to a long commute, Alex incur substantial penalties. Upon reflection, buy a pre own vehicle with no mileage restrictions would have been a more cost-effective choice for Alex’s lifestyle.

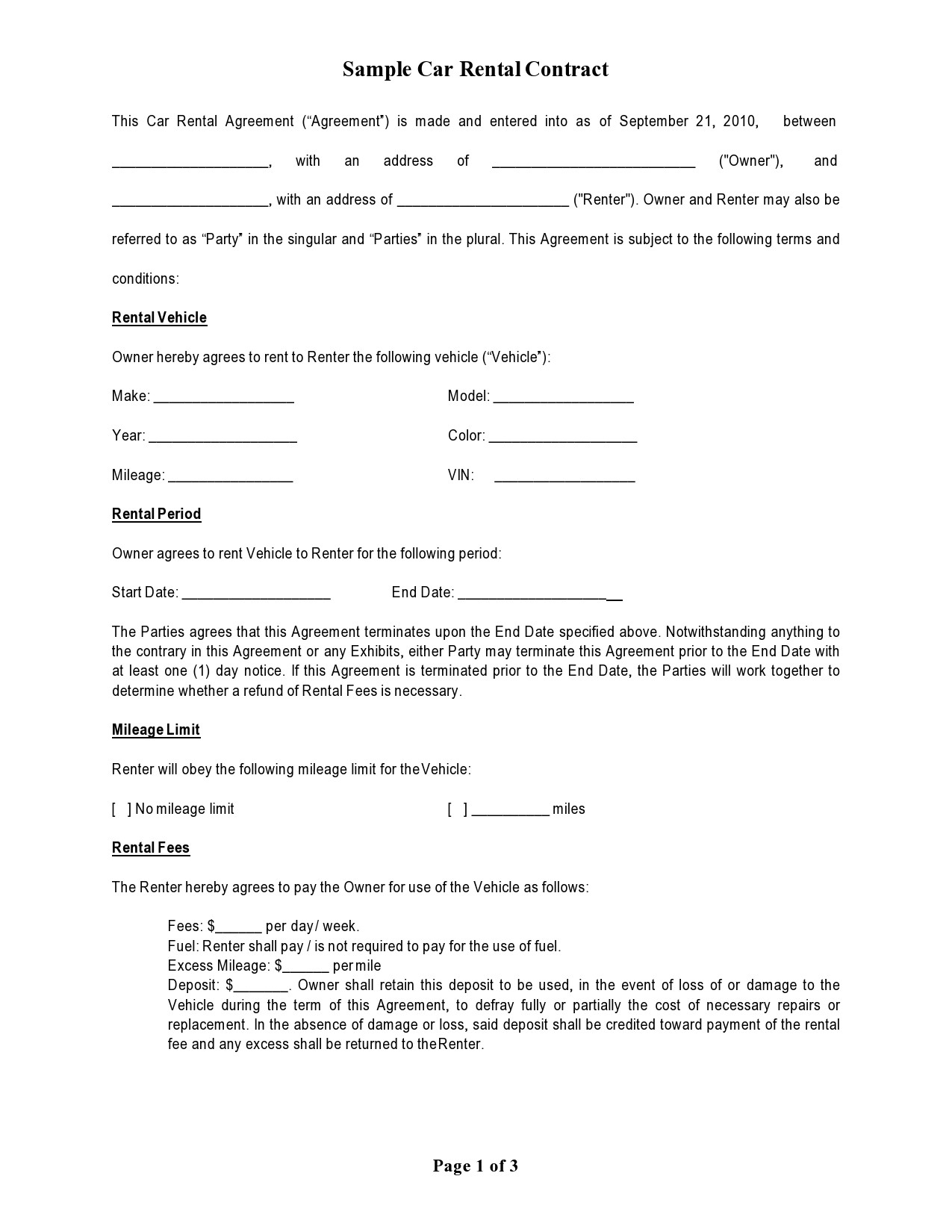

Source: templates.rjuuc.edu.NP

Source: templates.rjuuc.edu.NP Factors to consider

When decide whether to lease or buy, consider the follow factors:

- Drive habits: Evaluate your driving needs, include annual mileage and commute distance.

- Financial situation: Analyze your budget for upfront costs and long term financial commitments.

- Lifestyle need: Consider how frequently you prefer to update your vehicle and whether you enjoy the latest technology.

- Future plans: Think about how your life might change in the next few years, such as potential job relocations or family expansions.

Conclusion

Choose whether to lease or buy a vehicle finally depend on your personal circumstances and preferences. Leasing may be ideal for those who enjoy drive new cars without the burden of ownership, while buy suits individuals look for long term value and flexibility. By understand the pros and cons and consider your unique situation, you can make a more informed decision. We encourage you to explore air, mmay hapby consult financial advisors or dealers, to find the best option for your needs.