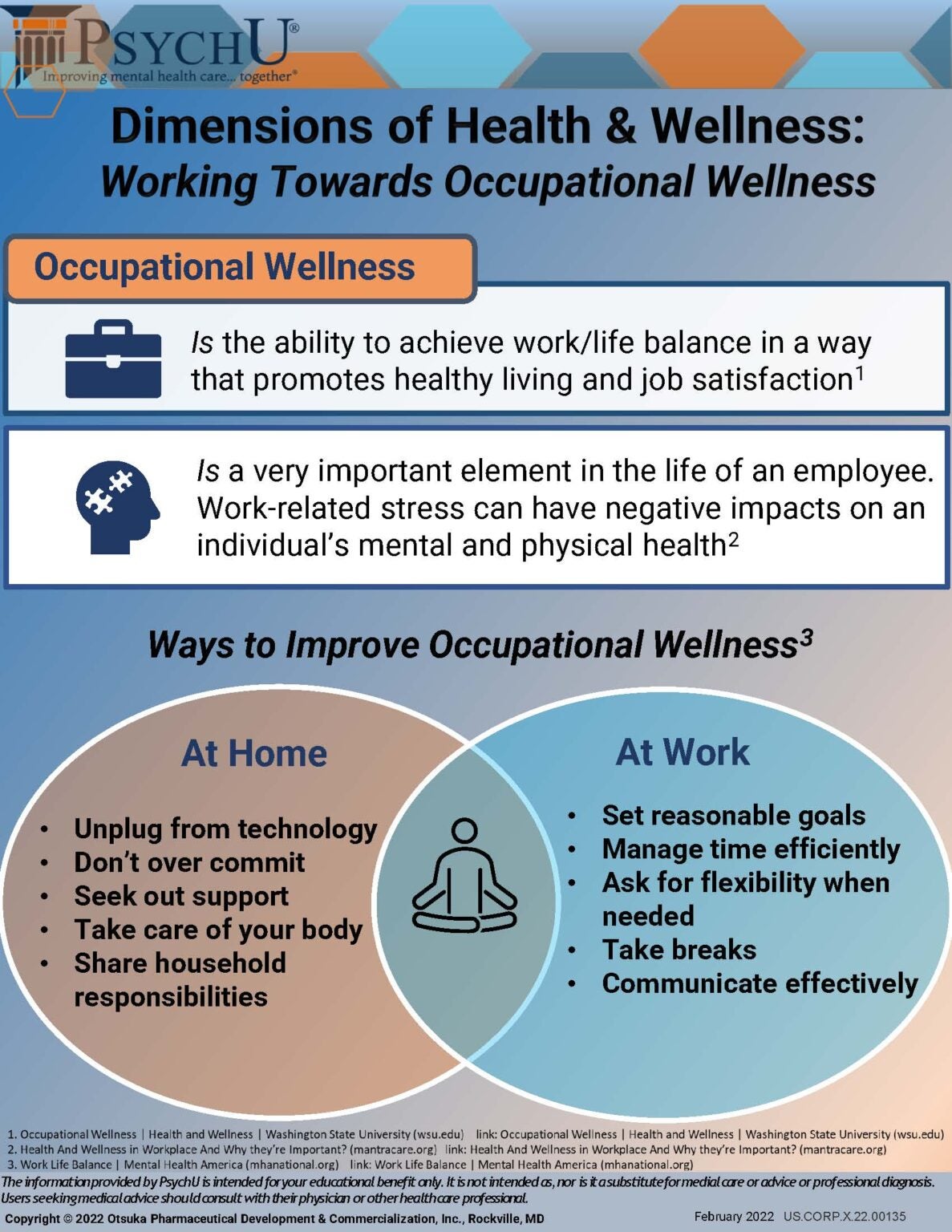

NTM in Finance: Understanding Net Tangible Assets and Financial Metrics

What does ATM mean in finance?

ATM in finance chiefly stand for” net tangible assets,” a crucial metric that measure a company’s physical assets minus its liabilities and intangible assets. This financial indicator provide investors and analysts with a clear picture of what shareholders would receive if a company were liquidated instantly.

Net tangible assets represent the tangible book value of a company, exclude goodwill, patents, trademarks, and other intangible assets. Financial professionals use this metric to assess the underlying value of a business base entirely on its physical assets and concrete financial positions.

Calculate net tangible assets

The formula for calculate ATM is straightforward:

ATM = total assets total liabilities intangible assets

This calculation remove the subjective valuations oft associate with intangible assets, provide a more conservative estimate of company value. The result figure represent the minimum value shareholders could expect in the worst case liquidation scenario.

When perform this calculation, analysts must cautiously identify and exclude all intangible assets, include goodwill from acquisitions, intellectual property, brand value, and customer relationships. The remain tangible assets typically include cash, inventory, equipment, real estate, and other physical assets.

Importance of ATM in investment analysis

Net tangible assets serve multiple purposes in financial analysis. Value investors oftentimes use this metric to identify undervalued companies trade below their tangible asset value. When a stock trade below its ATM per share, it may indicate a potential bargain or suggest underlying business challenges.

Banks and lending institutions rely intemperately on ATM calculations when evaluate loan applications and determine collateral value. Tangible assets provide security for lenders because they can be liquidated to recover funds if borrowers default on their obligations.

The metric prove especially valuable when analyze asset heavy industries such as manufacturing, real estate, and utilities. Companies in these sectors typically possess substantial physical assets that retain value still during economic downturns.

ATM across different industries

The relevance of net tangible assets vary importantly across industries. Traditional manufacturing companies, real estate firms, and resource extraction businesses typically show higher ATM values due to their substantial physical asset bases.

Technology companies oft display lower or level negative ATM values because their primary value lie in intellectual property, software, and human capital quite than physical assets. For these companies, traditional ATM analysis may not accurately reflect true business value.

Financial services firms present unique challenges for ATM analysis. Banks and insurance companies hold different types of assets, and their business models rely intemperately on intangible factors such as customer relationships and regulatory licenses.

Limitations of net tangible assets

While ATM provide valuable insights, it has several limitations that investors must consider. The metric assume liquidation values for assets, which frequently fall below their operational value within a function business. Equipment and inventory may sell for importantly less than book value during forced liquidation.

Market conditions intemperately influence the actual value of tangible assets. Real estate values fluctuate with economic cycles, and specialized equipment may have limit resale markets. The book value of assets may not reflect current market conditions or technological obsolescence.

Source: YouTube.com

ATM analysis besides ignore the earn power of intangible assets. Companies with strong brands, patents, or customer relationships may generate substantial cash flows that exceed their tangible asset value. Focus exclusively on tangible assets may cause investors to overlook profitable opportunities.

ATM per share analysis

Calculate ATM per share provide a more meaningful comparison tool for investors. This metric divide total net tangible assets by the number of outstanding shares, create a per-share baseline value.

ATM per share = net tangible assets ÷ outstanding shares

Investors compare the ATM per share to the current stock price to identify potential value opportunities. Stocks trade below their ATM per share may warrant further investigation, though low prices much reflect legitimate business concerns.

This analysis work substantially when compare companies within the same industry, as different sectors have varied asset intensity and business models. Compare a technology company’ATMtm per share to a manufacture company’s metric provide little meaningful insight.

Practical applications in portfolio management

Portfolio managers incorporate ATM analysis into their investment strategies in various ways. Conservative investors may seek companies with high ATM values relative to market capitalization, provide downside protection during market volatility.

Distressed debt investors oftentimes analyze ATM to estimate recovery values for troubled companies. Understand the tangible asset base help predict potential returns if companies undergo restructuring or liquidation.

Merger and acquisition analysts use ATM calculations to establish minimum valuation floors for target companies. Acquirers can be more confident in deals where purchase prices remain closely to tangible asset values.

ATM in credit analysis

Credit analysts rely heavy on net tangible assets when evaluate borrower creditworthiness. Tangible assets provide collateral that lenders can claim if borrowers fail to meet their obligations. Higher ATM values broadly indicate stronger credit profiles and lower lending risk.

Asset base lending specifically focuses oATMtm calculations to determine loan amounts and terms. Lenders typically advance a percentage of tangible asset value, create a margin of safety for their investments.

Credit rating agencies incorporate ATM analysis into their rating methodologies, specially for companies in asset intensive industries. Strong tangible asset positions can support higher credit ratings and lower borrowing costs.

Compare ATM to other financial metrics

Net tangible assets complement other financial metrics but should not be use in isolation. Book value include intangible assets that ATM excludes, potentially provide a more complete picture of company value for businesses with significant intellectual property.

Market capitalization reflect investor sentiment and growth expectations that ATM calculations ignore. Companies with strong growth prospects may justifiably trade above their tangible asset values due to future earn potential.

Return on assets (rROA)measures how efficaciously companies utilize their asset base to generate profits. High ntATMalues mean little if companies can not generate adequate returns from their tangible assets.

Industry specific considerations

Real estate investment trusts (rrats))ypically show strong ntmATMlues due to their property holdings. Yet, property values fluctuate with market conditions, and geographic concentration can create additional risks not capture in basic ntmATMlculations.

Retail companies present complex ATM analysis challenges. Inventory values may deteriorate apace due to fashion changes or technological obsolescence. Store locations in prime areas may have significant real estate value, while locations in decline areas may be worth less than book value.

Energy companies oft show substantial ATM values from their reserves and equipment. Notwithstanding, commodity price volatility affect the true value of these assets, and environmental regulations may create additional liabilities not reflect in traditional ATM calculations.

Global considerations and accounting standards

International accounting standards can affect ATM calculations and comparisons. Different countries may have varied rules for asset valuation, depreciation methods, and intangible asset recognition. Investors analyze multinational companies or compare firms across borders must consider these differences.

Currency fluctuations add another layer of complexity to ATM analysis for international investments. Asset values denominate in foreign currencies may change importantly due to exchange rate movements, affect the underlie ATM calculations.

Political and regulatory risks in different countries can impact the realizable value of tangible assets. Assets locate in politically unstable regions may be worth less than their book values due to expropriation risks or operational restrictions.

Technology’s impact on ATM relevance

The digital transformation of business models has changed the relevance of net tangible assets across many industries. Companies progressively derive value from data, algorithms, and digital platforms quite than physical assets.

Source: pinterest.com

Cloud computing has reduced the need for companies to own substantial it infrastructure, potentially lower theirATMm values while maintain or increase their operational capabilities. This shift challenge traditional asset base valuation methods.

Artificial intelligence and automation are change the nature of valuable assets. Software and data may be more valuable than traditional machinery, but these assets oftentimes don’t appear in ATM calculations due to their intangible nature.

Future outlook for ATM analysis

Net tangible assets will potential will remain relevant for asset intensive industries, but their importance may will diminish for technology and service will base companies. Investors and analysts are developed new metrics to capture the value of intangible assets and digital capabilities.

Environmental, social, and governance (eESG)factors are become progressively important in investment decisions. Future ntATMnalysis may need to incorporate environmental liabilities and social costs that traditional calculations ignore.

Regulatory changes regard asset recognition and valuation could affect how companies report their tangible assets. Investors must stay informed about accounting standard changes that might impact ATM calculations and comparability over time.