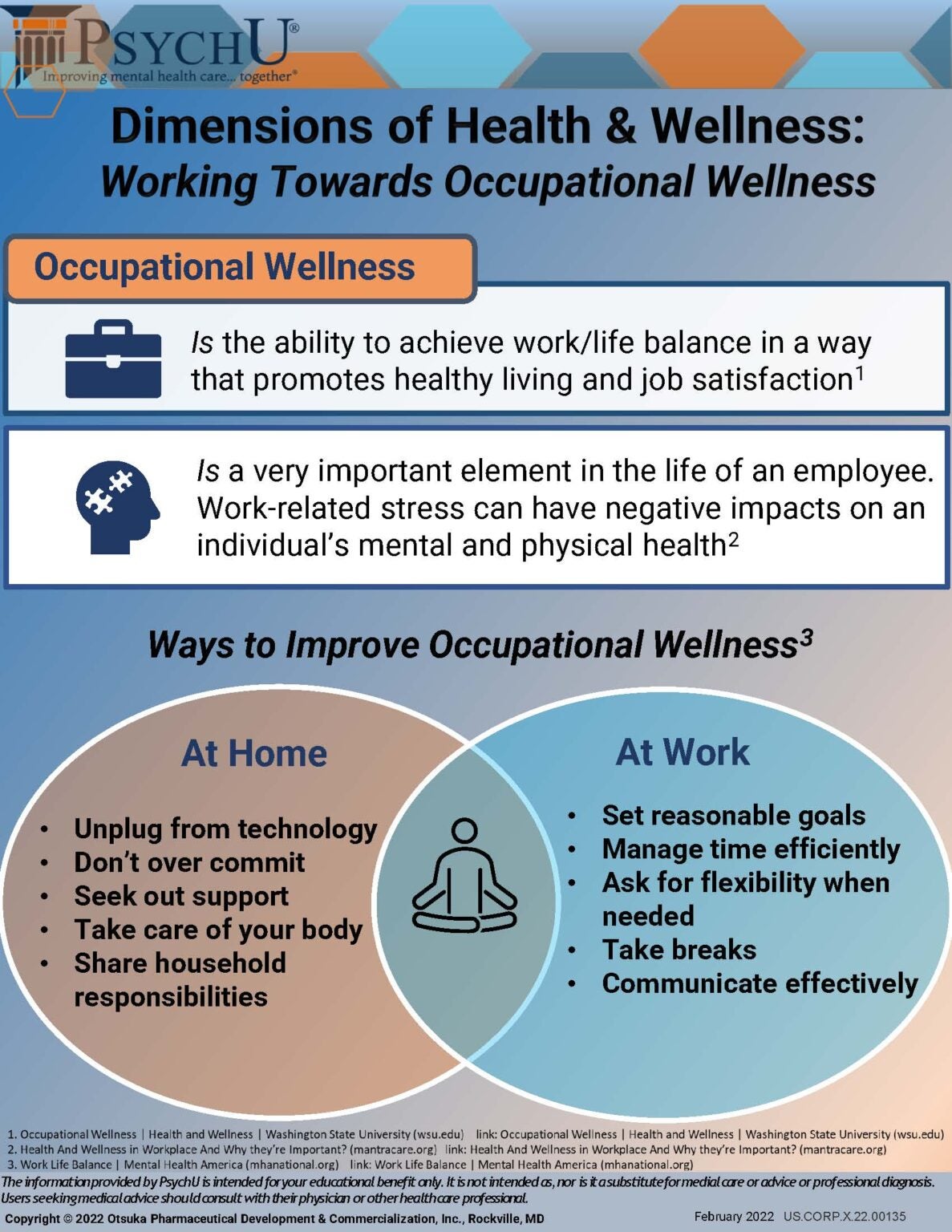

Seller Credit in Real Estate: Complete Guide to Closing Cost Assistance

Understanding seller credit in real estate transactions

Seller credit represent a powerful financial tool in real estate transactions where the property seller agree to pay a portion of the buyer’s closing costs. This arrangement allow buyers to reduce their out-of-pocket expenses at closing while potentially help sellers close deals more efficaciously.

The concept work by have the seller contribute funds toward various buyer expenses, include loan origination fees, appraisal costs, title insurance, and other closing relate charges. These credits appear as line items on the settlement statement, direct reduce the amount buyers must bring to the closing table.

How seller credits function in practice

When a seller agrees to provide credit, they fundamentally increase the home’s sale price to accommodate the credit amount while simultaneously agree to pay specific buyer costs. For example, if a home sell for$3000,000 with a $5,000 seller credit, the transaction efficaciously ooperatesas though the buyer purchases the home for$2955,000 while receive assistance with closing expenses.

The credit amount gets build into the mortgage loan, mean buyers finance the seller contribution over the life of their loan kinda than pay those costs upfront. This arrangement prove peculiarly valuable for buyers who have sufficient income to qualify for a mortgage but limited cash reserves for closing costs.

Lenders typically require that seller credits not exceed the buyer’s actual closing costs. Any excess credit can not be return to the buyer as cash, make accurate estimation of closing expenses crucial for determining appropriate credit amounts.

Source: ninebp.com

Maximum seller credit limits by loan type

Different mortgage programs impose vary restrictions on seller credit amounts, typically express as percentages of the home’s sale price or appraise value, whichever is lower.

Conventional loans allow seller credits up to 3 % of the sale price for investment properties, 6 % for primary residences with down payments of 10 % or more, and 9 % for primary residences with down payments below 10 %. These limits provide substantial flexibility for negotiate closing cost assistance.

Source: c21bb.com

FHA loans permit seller credits up to 6 % of the sale price, while VA loans allow up to 4 % in seller concessions. USDA loans typically restrict seller credits to 6 % of the sale price, though specific program requirements may vary.

These limitations exist to prevent inflated sale prices that unnaturally increase loan amounts beyond actual property values. Lenders want to ensure that seller credits represent legitimate closing cost assistance kinda than disguised cash back arrangements.

Eligible expenses for seller credits

Seller credits can cover numerous legitimate closing costs, but understanding which expense qualify help buyers and sellers structure effective agreements.

Loan relate fees represent the nigh common use of seller credits, include origination fees, discount points, credit report charges, and loan processing costs. These expenses direct relate to obtain financing and typically constitute the largest portion of closing costs.

Third party services besides qualify for seller credit coverage, such as appraisal fees, home inspection costs, title insurance premiums, and attorney fees. Property relate expenses like survey costs, pest inspection fees, and recording charges likewise qualify for seller credit assistance.

Prepaid expenses present another category of eligible costs, include property taxes, homeowners insurance premiums, and mortgage interest that must be pay in advance. Some lenders besides allow seller credits to cover initial escrow account deposits for taxes and insurance.

Notwithstanding, certain expenses typically can not be cover by seller credits, include the buyer’s down payment, real estate agent commissions, and personal expenses unrelated to the property transaction.

Strategic benefits for buyers

Seller credits provide multiple advantages for homebuyers, specially those with limited cash reserves or specific financial goals.

Immediate cash flow relief represent the primary benefit, allow buyers to preserve cash for moving expenses, home improvements, or emergency reserves. This advantage prove specially valuable for first time buyers who may have saved diligently for a down payment but lack additional funds for closing costs.

The ability to finance closing costs through the mortgage can too improve buyers’ overall financial position. Kinda than deplete savings accounts, buyers can spread these costs over the loan term while maintain liquidity for other needs.

Seller credits can make homeownership accessible to buyers who might differently struggle to complete transactions due to insufficient closing funds. This accessibility can expand the pool of potential buyers for sellers while help qualified individuals achieve homeownership goals.

Tax implications may too favor finance closing costs kinda than pay them upfront, though buyers should consult tax professionals for guidance specific to their situations.

Advantages for sellers

While seller credits require sellers to contribute funds toward buyer expenses, these arrangements oftentimes provide strategic advantages in competitive markets or challenge sales situations.

Offer seller credits can make properties more attractive to buyers, especially in markets where multiple homes compete for buyer attention. The promise of closing cost assistance may differentiate a property from similar listings and generate more serious inquiries.

Sellers face extended marketing periods may find that offer credits help expedite sales by remove financial barriers for potential buyers. The cost of carry a property for additional months oftentimes exceed the expense of provide reasonable seller credits.

In some cases, seller credits enable sellers to maintain higher listing prices while stock still provide buyer incentives. This strategy can be especially effective when sellers need to achieve specific sale prices for mortgage payoff or other financial obligations.

Seller credits may too appeal to buyers more than equivalent price reductions because the credits direct address a common buyer pain point – limited cash for closing costs.

Negotiation strategies and timing

Successful seller credit negotiations require careful planning and strategic communication between all parties involve in the transaction.

Buyers should research typical closing costs in their area and loan program before make offers. This knowledge enables realistic credit requests that align with actual expenses and lender limitations. Overestimate need credits can complicate transactions unnecessarily.

Market conditions importantly influence negotiation success. In buyer’s markets with ample inventory, sellers may be more willing to provide credits to attract offers. Conversely, competitive seller’s markets may limit opportunities for substantial credit requests.

Time credit requests befittingly can improve acceptance rates. Include credit requests in initial offers allow sellers to evaluate the complete proposal, while last minute requests during the transaction process may face resistance.

Professional guidance from experienced real estate agents help both buyers and sellers navigate credit negotiations efficaciously. Agents understand local market practices and can structure proposals that benefit all parties.

Impact on property appraisals

Seller credits can affect property appraisals and loan approval processes, make understand these implications crucial for successful transactions.

Appraisers evaluate whether sale prices reflect fair market value, consider any seller concessions in their analysis. Excessive credits relative to the sale price may raise questions about whether the property’s value support the contract price.

When seller credits are substantial, appraisers may adjust their comparable sales analysis to account for the concessions. This adjustment help ensure that the properties appraise value accurately reflect its market worth kinda than inflated pricing design to accommodate credits.

Lenders review appraisal reports cautiously when seller credits are involved, look for any indications that sale prices exceed fair market value. Properties that appraise below contract price may require renegotiation of credit amounts or other contract terms.

Buyers and sellers can minimize appraisal complications by ensure that credit amount align with typical market practices and don’t result in sale prices importantly above comparable properties.

Common mistakes to avoid

Several pitfalls can complicate seller credit arrangements, but awareness of these issues help parties structure successful agreements.

Request credits that exceed actual closing costs represent a frequent mistake that can delay closings or require contract modifications. Buyers should obtain good faith estimates from lenders before negotiate credit amounts.

Fail to understand loan program limitations can result in credit requests that exceed allowable limits, necessitating contract revisions or alternative arrangements. Each loan type have specific rules that must be followed.

Inadequate documentation of credit arrangements can create confusion at closing. All credit agreements should be clear to specify in purchase contracts with detailed descriptions of cover expenses.

Overlook the impact of credits on loan amounts and monthly payments can surprise buyers who don’t realize they’re finance these costs over the loan term. While credits reduce upfront expenses, they increase the total loan balance and monthly payment obligations.

Alternative closing cost assistance options

While seller credits represent one approach to manage closing costs, buyers should understand other available options for reduce these expenses.

Lender credits offer another avenue for closing cost assistance, where mortgage companies provide credits in exchange for somewhat higher interest rates. This arrangement may benefit buyers who prefer to avoid negotiate seller concessions.

Down payment assistance programs, available through various government and nonprofit organizations, can help eligible buyers with both down payments and closing costs. These programs oftentimes target first time buyers or specific income levels.

Gift funds from family members can cover closing costs without affect loan terms or property values. Nonetheless, lenders have specific requirements for document gift transactions that must be followed cautiously.

Some buyers choose to roll closing costs into their loan amount through no closing cost mortgages, though these arrangements typically involve higher interest rates to compensate lenders for advance the funds.

Make informed decisions about seller credits

Seller credits can provide valuable benefits for both buyers and sellers when structure befittingly and use strategically. Buyers gain access to homeownership with reduced upfront costs, while sellers can attract more buyers and potentially expedite sales.

Success with seller credits require understand loan program limitations, accurately estimate closing costs, and negotiate agreements that benefit all parties. Professional guidance from experienced real estate agents and mortgage professionals help ensure that credit arrangements comply with lender requirements and support transaction success.

Market conditions, property values, and individual financial situations all influence whether seller credits represent the best approach for manage closing costs. Buyers and sellers should evaluate all available options before commit to specific arrangements.

Finally, seller credits represent one tool among many for structure successful real estate transactions. When use befittingly, they can help overcome financial obstacles and facilitate homeownership for qualified buyers while provide sellers with effective marketing strategies.